Today, consumers have more payment options than ever before. So, according to an expert in the field of international financial law Konstantin Krypopustwe are entering an era where people, not technology, are crucial. This is an era where consumer choice is the main driver of the payment landscape.

Worldpay recently introduced a traditional report “The global payments report 2024”, which analyzed the most relevant payment trends in the world. We have collected the key findings from the study.

8 trends in the field of payments

- Digital wallets are the choice of consumers.

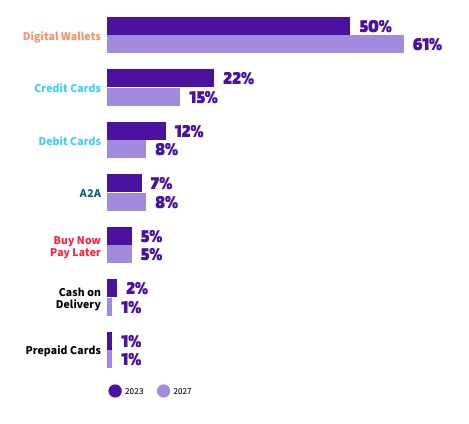

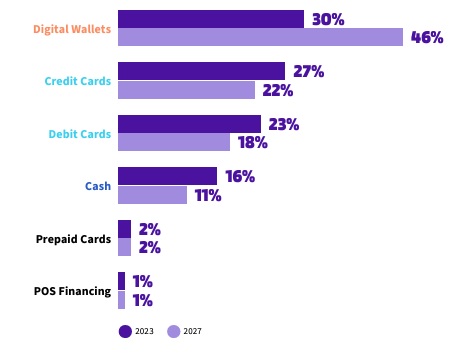

In 2023, digital wallets accounted for 50% of global e-commerce spending (more than $3.1 trillion) and 30% of global payments made through POS terminals at points of sale (more than $10.8 thousand). By 2027, digital wallets are predicted to collectively account for about 49% (over $25 trillion) of e-commerce and point-of-sale transactions. - Cards remain in demand.

The popularity of digital wallets did not cause the abandonment of bank cards. In markets where cards have traditionally dominated payment methods, card payments are increasingly being made using wallets such as Apple Pay, Google Pay and PayPal. Overall, the value of card transactions is at an all-time high and continues to rise. - Account-to-account (A2A) payments compete with cards.

Account-to-account payments are gaining popularity in countries such as Brazil, India and Poland, but have not taken off in markets that have traditionally preferred cards (such as the US). - Demand for BNPL remains steady.

In 2023, BNPL providers faced challenges such as rising interest rates, regulatory changes and deteriorating investor sentiment. However, consumers continued to use BNPL schemes. Therefore, banks, fintech companies and bigtech companies are increasingly implementing such an opportunity to meet customer demand. - Global e-commerce growth is outpacing POS by a ratio of 2:1.

The volume of e-commerce in the world exceeded $6.1 trillion in 2023. This indicator is growing twice as fast as the volume of transactions made through POS terminals in the world. E-commerce is projected to grow at an average of 9% annually until 2027 (compared to 4% for POS). In 2023, the share of e-commerce in the total volume of global trade reached 14.4%, and by 2027 it may exceed 17%. - Cash remains relevant amid economic uncertainty.

In 2023, the volume of cash payments worldwide decreased by 8% and is projected to decrease by an average of 6% per year until 2027. However, cash remains a vital payment tool for billions of consumers. - The volume of payments using prepaid cards will exceed $1 trillion by the end of 2024.

Versatility makes prepaid cards successful: they are used as gift cards, payroll cards, business-to-business payments, government benefits cards, and more. Prepaid cards support financial inclusion by serving underbanked consumers. - More and more users refuse postpaid.

This signals the development of financial availability. Postpaid remains popular in Latin American countries, but in general, the global trend indicates a gradual abandonment of this type of payment against the background of increasing financial availability and decreasing popularity of cash.

The most popular e-commerce payment methods in the world

The most popular payment methods through POS terminals in the world

Why have digital wallets become so popular?

Consumers chose digital wallets in 2023 – $14 trillion worth of payments were made using this payment method. As of today, digital wallets are the leading e-commerce payment method in Asia Pacific, Europe and North America. According to forecasts, by 2027, digital wallets will lead the field of electronic payments in all regions of the world.

As for payments at retail outlets, digital wallets are most often used in the countries of the Asia-Pacific region (50%). By 2027, digital wallets are expected to become the leading payment method through POS terminals in Latin America and the Middle East, particularly in markets where cards have not been dominant.

The spread of QR codes contributes to the popularity of digital wallets, the study notes. Juniper Research predicts that by 2028, the number of payments made using QR codes in Southeast Asian countries will grow by more than 590%.

In turn, the basic infrastructure for using QR codes is provided by real-time payment systems from central banks and banking associations, such as BI-FAST in Indonesia, UPI in India, DuitNow in Malaysia, BancNet in the Philippines, PayNow in Singapore, and PromptPay in Thailand.

Payment trends in Europe

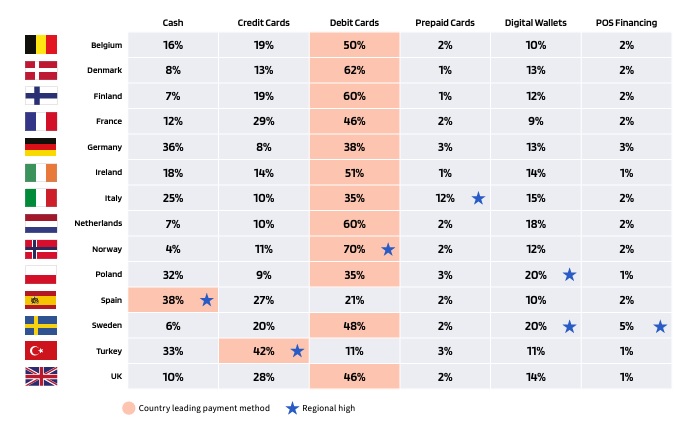

The e-commerce payment landscape in Europe is extremely diverse. Credit cards, debit cards, account-to-account transfers and digital wallets are not giving up their leadership positions. This diversity reflects the importance of local traditions, history, politics, culture, and economics when it comes to consumer payment behavior.

Digital wallets are the leading e-commerce payment method in five European markets: Denmark, Germany, Italy, Spain and the UK. In 2023, wallets accounted for 30% of the total volume of e-commerce transactions in these countries. This figure is projected to increase to 40% by 2027.

Wallet brands such as Amazon Pay, Apple Pay, Google Wallet and PayPal are major players in Europe. And local wallets have significant influence in Denmark (MobilePay), Finland (Pivo), Norway (Vipps) and Turkey (BKM Express, Maximum Mobil).

Last year, account-to-account (A2A) payments were the leading online payment method in Finland, the Netherlands, Norway, Poland and Sweden. A2A is particularly dominant in the Netherlands and Poland, where iDEAL and BLIK are the preferred choice for online payments among Dutch and Polish consumers, respectively. In 2023, account-to-account payments accounted for 18% of the total volume of e-commerce transactions in Europe.

As for payments at retail outlets, European consumers prefer to use debit cards. In 2023, debit cards accounted for 41% of POS transactions across Europe (over $2.7 trillion) – almost double the share of credit cards (21%).

The use of digital wallets in European retail outlets is growing – now it is a share of 13%. It is predicted that by 2027 this figure will increase to 27%.

The use of cash in Europe has halved compared to pre-pandemic times. Last year, cash accounted for around 20% of transactions by value at points of sale in 14 European markets, compared to 40% in 2019. The use of cash still varies significantly across Europe, from a low single-digit percentage in the Nordic countries to more than a quarter of the value of POS transactions in Germany, Italy, Poland, Spain and Turkey. However, the use of cash continues to fall in all markets.