Federal Reserve Bank of Atlanta in the summer published survey results on payment preferences and habits of American consumers. As of June 2024, three-quarters of US consumers used digital payments through tools such as PayPal, Zelle, Venmo and Cash App, and 70% of those surveyed made a payment using a mobile phone or tablet at least once in the previous 12 months.

Credit cards vs. payment accounts

According to the survey, 99% of US consumers have a credit, debit or prepaid card. That is, only 1% of US consumers do not use cards, while 4% of US consumers do not use banking services. About a third of those who do not have a bank account “don’t like dealing with banks”, and about 20% consider banking services too expensive.

The figure of 4% of unbanked U.S. consumers hasn’t changed much in recent years, but the number reflects the use of non-bank checking accounts, which are now used by nearly three-quarters of consumers overall.

Use of payment instruments

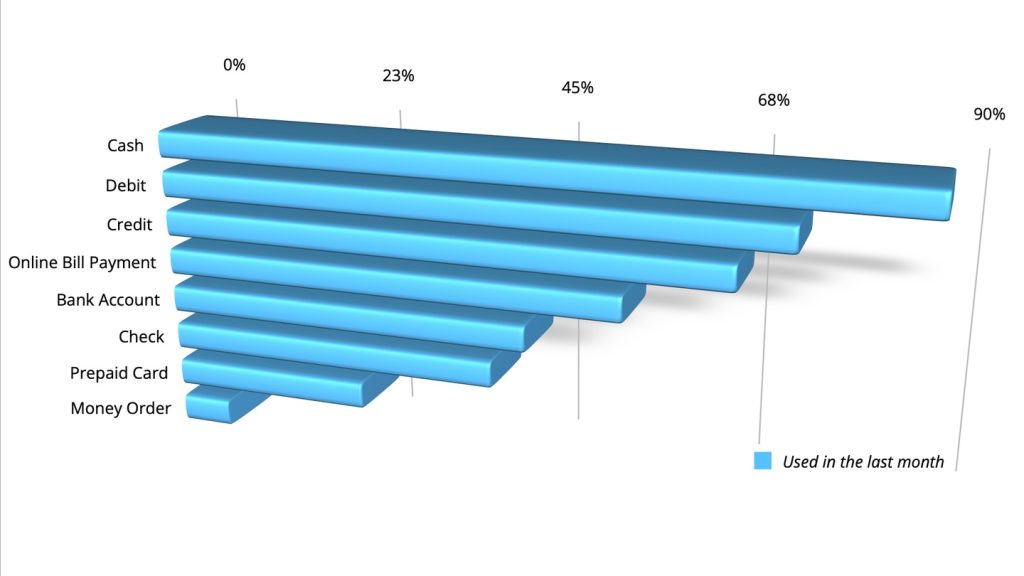

When asked which payment tools you personally used in the past month, US consumers responded as shown in the chart below.

As you can see, payments from account to account have overtaken checks, but so far almost half of the respondents have written a check at least once during the last month. U.S. checkbook use varies by consumer age group—those aged 55-64 are the most likely to write a check monthly, while nearly half of those ages 18-24 have never written a check.

As for cash, according to a 2019 survey, the average amount of cash a US consumer kept in their pocket, purse or wallet was $60. This indicator significantly increased in 2020, probably due to the pandemic, and amounted to $76, and later rose to $81 in 2023.

Meanwhile, according to Marqeta’s State of Payments 2024 report, nearly three-quarters of US consumers are positive about moving to a cashless society. More than a quarter of respondents said that it is inconvenient for them to pay in cash, and among respondents aged 18 to 34, 50% of respondents support this opinion.