Ukrainian fintech: key figures

- The Ukrainian fintech market includes 256 companies.

- 3 of them were founded in 2023.

- 75% of fintech companies have broken even.

- 79% of companies are financed exclusively with their own funds.

- 47% of companies operate on the international market.

- 79% of Ukrainian fintech companies are based in Kyiv.

- 16% are founded by women.

- 60% of fintech companies have representatives in the ranks of the Armed Forces.

Trends in the Ukrainian fintech market: changes in regulation

During the past year, the Concept of open banking was approved in Ukraine, as well as the Concept of reforming the regulation of factoring in Ukraine was approved.

In addition, the text of the draft law “On Amendments to the Tax Code of Ukraine and other legislative acts on regulating the turnover of virtual assets in Ukraine” was presented. The adoption of this draft law will allow to create an efficient market of virtual assets in Ukraine and establish rules for taxation of operations with a new class of assets in accordance with the European standards for the regulation of crypto-assets Markets in Crypto Assets (MiСА).

Trends of the Ukrainian fintech market: growth

75% of Ukrainian fintech companies broke even, 31% of them did so in the first year of operation.

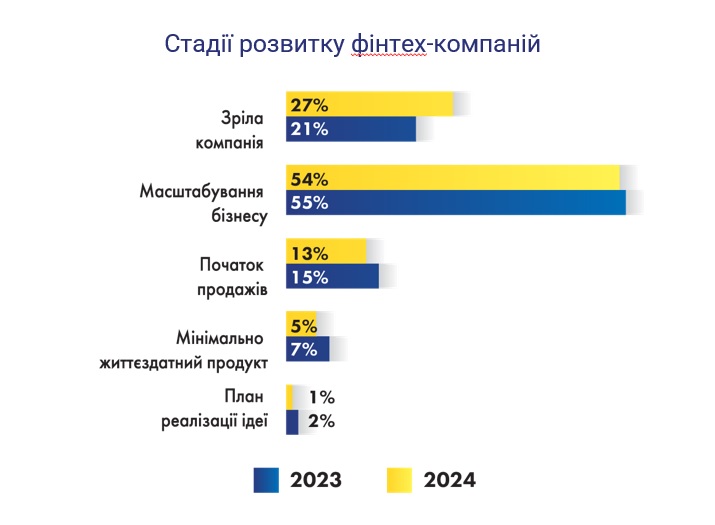

The majority of fintech companies surveyed (54%) are in the business scaling stage, compared to 55% in 2023. 27% of respondents are mature companies.

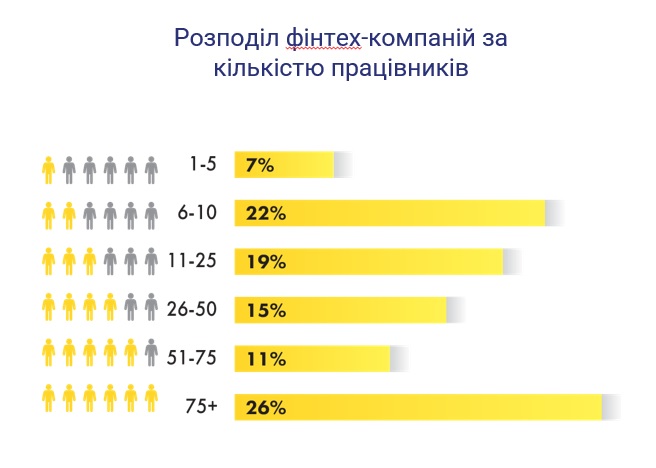

26% of surveyed fintech companies have more than 75 employees, 22% have 6 to 10 employees. Only 7% of fintechs have up to 5 people in their team.

79% of Ukrainian fintech companies are based in Kyiv, 5% in Lviv, 4% each in Kharkiv and Dnipro. 5% of fintech companies are located exclusively abroad.

89% of Ukrainian fintech companies call Ukraine their key market, 29% already operate in the European market, 20% in the Asian market, and 16% in the US market.

38% of fintechs surveyed plan to enter the international arena, 15% do not.

Trends of the Ukrainian fintech market: the market

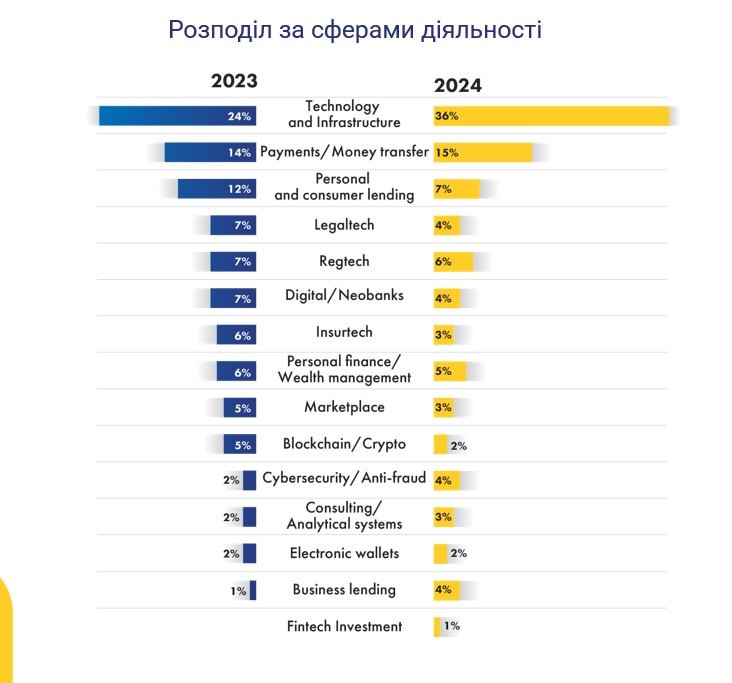

The most popular field of activity among fintech companies of Ukraine is invariably IT, followed by payments and money transfers, and consumer lending in third place. The share of the latter decreased from 12% in 2023 to 7% in 2024.

It is noteworthy that the share of neobanks also decreased – from 7% in 2023 to 4% this year. And such a field as fintech investment also appeared.

3% of surveyed companies occupy about 80% of the total market of their industry. 25% is less than 1%, which is explained by the fact that 19% of the surveyed companies are startups.

Trends of the Ukrainian fintech market: financing

39% of surveyed fintech companies plan to enter into a partnership with a strategic investor from abroad. And 32% had already attracted investments earlier, half of them directed funds for capital investments.

Currently, 79% of fintech companies are financed by their own funds, 7% by private investors, and 4% by venture capital funds.

45% of fintech companies plan to continue raising their own funds, 39% are looking for private investors. 31% plan to attract investments from venture funds.

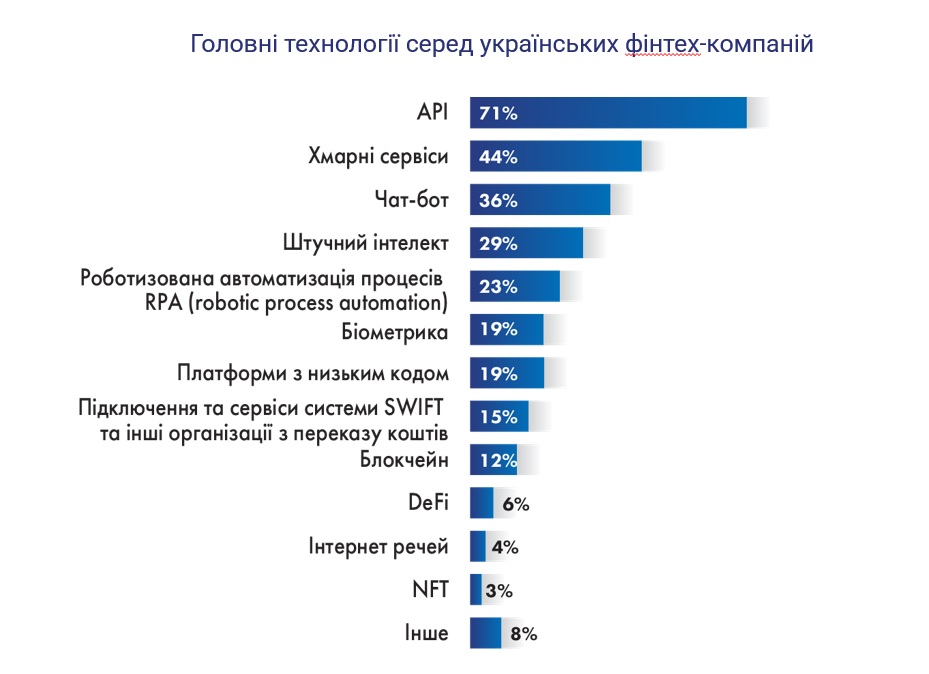

94% of fintech companies indicated artificial intelligence as one of the promising technologies for the Ukrainian market. Also, the main technologies among Ukrainian fintech companies are APIs (as indicated by 71% of respondents), cloud services (44% of respondents) and chatbots (36%).

Ukrainian fintech during the war

57% of surveyed fintech companies noted an increase in the valuation of their business. 40% of companies have problems with access to financing.

37% of companies have problems of a regulatory nature with access to other markets, and 60% noted difficulties in finding employees.

The surveyed companies named the most relevant tools for business development during the war:

- marketplaces for promoting services abroad (59%)

- matching service platform (42%)

- a national platform for finding investors for micro, small and medium-sized businesses (36%).

The map of the Ukrainian fintech ecosystem in 2024 looks like this: