To support the economy of Ukraine, which is currently significantly weakened as a result of Russian aggression, a number of countries have decided to cancel import duties on Ukrainian products.

Great Britain was one of the first to announce its intention to abolish import duties and special protective duties on metal products in the form of a tariff quota with a 25% duty. The agreement between the countries on the abolition of import duties and tariff quotas in bilateral trade was signed more than a month ago, and currently the internal procedures for agreement are still ongoing in the United Kingdom.

Subsequently, on April 27, the European Commission proposed to cancel import duties on Ukrainian exports to EU countries. The decision entered into force and the European Union abolished customs duties on all goods from Ukraine for a year, until June 5, 2023. According to the EU decision for Ukraine:

- tariffs for industrial products are abolished;

- the application of the input price system for fruits and vegetables is suspended;

- all tariff quotas for agricultural products are suspended;

- the effect of anti-dumping duties on the import of goods originating in Ukraine is suspended (seamless pipes with a duty of up to 25.7% and hot-rolled steel in the amount of EUR 60.5 per ton);

- the application of global protective measures for Ukrainian goods is suspended (metal products in the form of a tariff quota with a 25% duty).

Canada also announced its intention to cancel all tariffs on Ukrainian goods for a year. The changes will enter into force after the adoption of the relevant decree and its publication, and on the basis of this, the Canada Border Services Agency will issue the relevant customs orders. In addition, Canada informed about the suspension of anti-dumping duties in the amount of 77% on hot-rolled coils from Ukraine. Along with this, anti-dumping measures are currently in force on Ukrainian hot-rolled edged products in the amount of up to 21.3% and steel pipes in the amount of 37.4%.

As of June 1, 2022, the United States suspended the collection of a 25% customs duty on Ukrainian goods for one year. However, the suspension does not apply to the current US anti-dumping measures against Ukrainian products. Currently, anti-dumping measures remain in force on Ukrainian ferrosilicomanganese in the amount of up to 21.3%, fittings in the amount of 41.7%, rolled steel – up to 237.91%, steel pipes – 7.47%, wire rod – up to 44.03%, twisted wire – 19.3%, seamless pipes – 23.75%.

Therefore, the EU countries and partially the USA opened their market for Ukrainian exports the most.

What does the abolition of import duties mean for Ukrainian exporters in practice?

In order to provide a full and justified answer to this question, it is necessary to analyze the dynamics and structure of Ukrainian exports. In general, the dynamics of Ukrainian export of goods over the past ten years shows the constant influence of the Russian factor on the volume and structure of imports, in particular, in 2013-2015, the volume of Ukrainian exports fell significantly due to trade restrictions of the Russian Federation, transit restrictions, the annexation of the Autonomous Republic of Crimea and Russia’s military aggression in eastern Ukraine .

One of the positive factors thanks to which it was possible to stop the decline and start the recovery of Ukrainian exports in 2016-2021 was the opening of the EU market for Ukrainian goods (Ukraine and the EU began to apply the provisions of the Free Trade Agreement from January 1, 2016 as part of the Association Agreement, the political provisions came into force in November 2014).

The agreement with the EU significantly improved the competitiveness of Ukrainian business on the EU market, canceling 94.7% of tariff lines for exports to the EU, the rest of the tariffs provided for gradual cancellation with corresponding transition periods. The longest transition periods (until 2023) were set for fertilizers, aluminum products, cars and other transport activities. At the same time, with regard to agricultural products, tariffs in the EU were reduced to zero on most products in 2016. For some agricultural products (beef, pork, mutton, poultry, milk, cream, yogurts, cereals, bran, honey, sugar, starch, mushrooms, garlic, malt, juices, butter, eggs and others) duty-free tariff quotas were established. The EU manages these quotas either on a first-come, first-served basis or with the help of import licenses.

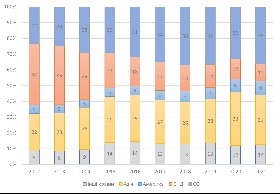

In general, since the signing of the Association Agreement with the EU and the entry into force of the Free Trade Agreement, there have been radical changes in the geographical structure of Ukraine’s foreign trade. Before that, about a quarter of the domestic export of goods was directed to the EU countries, about a third – to the markets of the CIS countries, the rest – to other countries of the world. During 2014-2021, this distribution changed significantly: the share of CIS countries decreased significantly (from 37% to 11%), the share of EU countries increased significantly (from 22% to 36%), and the share of Asian countries, in particular China, increased (to 12.5% or up to $7.8 billion). At the same time, the share of the USA increased to 2.6% ($1.6 billion), Great Britain to 1.6% ($0.99 billion, Canada – to 0.3% ($0.2 billion). Thus, the European The Union became the largest trade partner of Ukraine with a specific weight of trade in goods of almost 40% of the total volume of foreign trade of Ukraine ($23 billion).

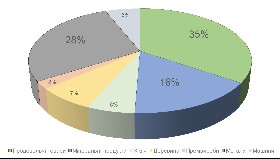

In 2021, the basis of Ukrainian commodity exports to the EU was food, metals and mineral products.

According to the geographical structure of Ukrainian exports to the EU, the largest trade partners of Ukraine are Poland, Italy, Germany, the Netherlands, and Hungary. Ukraine mainly exports iron ore raw materials, ferrous metals, and woodworking products to Poland. Domestic exports to Italy are concentrated on ferrous metals and grain. Exports to Germany consist mainly of sets of wires, rapeseed, iron ore raw materials, and clothing. Ukraine primarily supplies grain crops and sunflower oil to the Netherlands. Almost all domestic exports of electric water heating devices to the EU are concentrated in Hungary, a significant share is also made up of wire sets and iron ores.

The basis of Ukrainian exports to the USA in 2021 was the products of the mining and metallurgical complex of Ukraine – up to 72%, food products – 10%, mechanical engineering – up to 8%, and products of the chemical industry – 5%. To Great Britain in 2021, Ukraine mainly supplied food products (up to 50%), products of the mining and metallurgical complex of Ukraine (up to 28%) and mechanical engineering (up to 10%). Products of the mining and metallurgical complex of Ukraine (up to 43%), food products (18%), mechanical engineering (up to 20%) and products of the chemical industry (7%) were supplied to Canada. For comparison, in 2021, Ukraine exported mainly food products (up to 54%) and products of the mining and metallurgical complex of Ukraine (up to 41%) to China.

Thus, before the war, Ukraine increased its exports to Europe, America and Asia. At the same time, if Ukrainian exports to the EU countries were more or less diversified, then the products of the mining and metallurgical complex, whose main products (rolled steel, pipes, fittings, wires) were supplied to the USA and Canada, were subject to anti-dumping measures.

At the same time, with the beginning of a full-scale war, which the Russian Federation unleashed on February 24, 2022 and is waging against Ukraine, a significant number of infrastructure facilities, enterprises, and residential buildings were destroyed, which led to losses of hundreds of billions of dollars. In addition to the destruction, the war created significant problems with the supply of raw materials and logistics for Ukrainian exporters. Currently, access to Ukrainian ports on the Black and Azov seas is completely blocked (sea ports are officially closed until control is restored, order of the Ministry of Infrastructure of Ukraine dated April 28, 2022 No. 256 “On the closure of sea ports”). The war significantly undermined the production capacity of agriculture and industry in Ukraine.

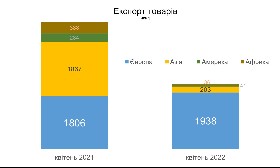

With the beginning of the war, the total volume of Ukrainian exports fell significantly. For comparison, if in April 2021 the volume of exports amounted to $4.9 billion, and in April 2022 it was only $2.4 billion. At the same time, the volume of Ukrainian exports fell the most to the countries of Africa (91%), Asia (89%) and America (86%), exports to Europe increased (7%). For comparison, the volume of exports to the CIS countries fell by 68%, and to the EU increased by 12%. Taking into account the mentioned changes, the share of the EU in the total volume of Ukrainian exports increased from 34% in April 2021 to 79% in April 2022.

Against the background of a significant drop in the total volume of Ukrainian exports since the beginning of the war, the fact that some restrictions on Ukrainian products have been lifted is undeniably good news. This will make it possible to partially compensate for the losses of Ukrainian exporters, primarily agricultural producers and metallurgists, when supplying products primarily to the EU, since logistical difficulties for Ukrainian exporters will not allow them to particularly take advantage of the partial opening of the US and Canadian markets. It is worth noting that due to the presence of anti-dumping measures, the access of Ukrainian metallurgists to these countries will still be limited.

At the same time, the EU opened the market much wider, canceling not only import duties and quotas, but also suspending anti-dumping measures. At the same time, Ukrainian manufacturers will be able to partially solve the logistical problems of supplying their own products to the EU by arranging the supply of goods by rail and road transport.

At the same time, with the abolition of customs duties, other barriers will remain for Ukrainian exporters when entering the European market:

- technical barriers associated with non-compliance of domestic quality standards with technical regulations and? product safety standards in the EU, that is, Ukrainian manufacturers who could not supply their own products to the EU due to differences in standards will not be able to import them;

- significant subsidies and subsidies received by producers of food products in the EU, which puts a number of domestic exporters of the corresponding goods on the edge of price competitiveness on the European market.

In addition to the advantages for Ukrainian exporters, there are some risks for Ukrainian producers. The EU resolution states that the suspension of customs duties applies only if Ukraine refrains from introducing new customs duties or quantitative restrictions for goods originating in the EU, or from increasing existing customs duties. In this context, it should be emphasized that Ukraine is actively using anti-dumping and special investigations to protect domestic manufacturers from imports and currently regarding products originating from the EU:

- applies anti-dumping measures on the import of rubber stoppers and special measures on products made of polyurethane foam, sulfuric acid, polymeric materials and fresh roses;

- conducts four special investigations on cheeses, sodium hypochlorite, drilling cuttings and PVC profile.

Thus, Ukraine should either abandon the protection of domestic producers and end current trade investigations without enforcement and not continue existing measures, or abandon the benefits of expanded access to the EU market for Ukrainian exporters.

So we can say that the opening of foreign markets for Ukrainian products is only partial and temporary. At the same time, taking into account the problems of Ukrainian manufacturers with the supply of raw materials and logistics, it is unlikely that Ukrainian exporters will be able to take full advantage of these advantages.